Welcome to Allan Gray Australia.

We want to ensure you get the right experience for you.

Individual Investors

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

Financial Advisers

The information contained in this section is for adviser and wholesale investor use only.

Retail Investors

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

The website is primarily designed for Australian investors.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Show investment objective, performance and more

Stable Fund

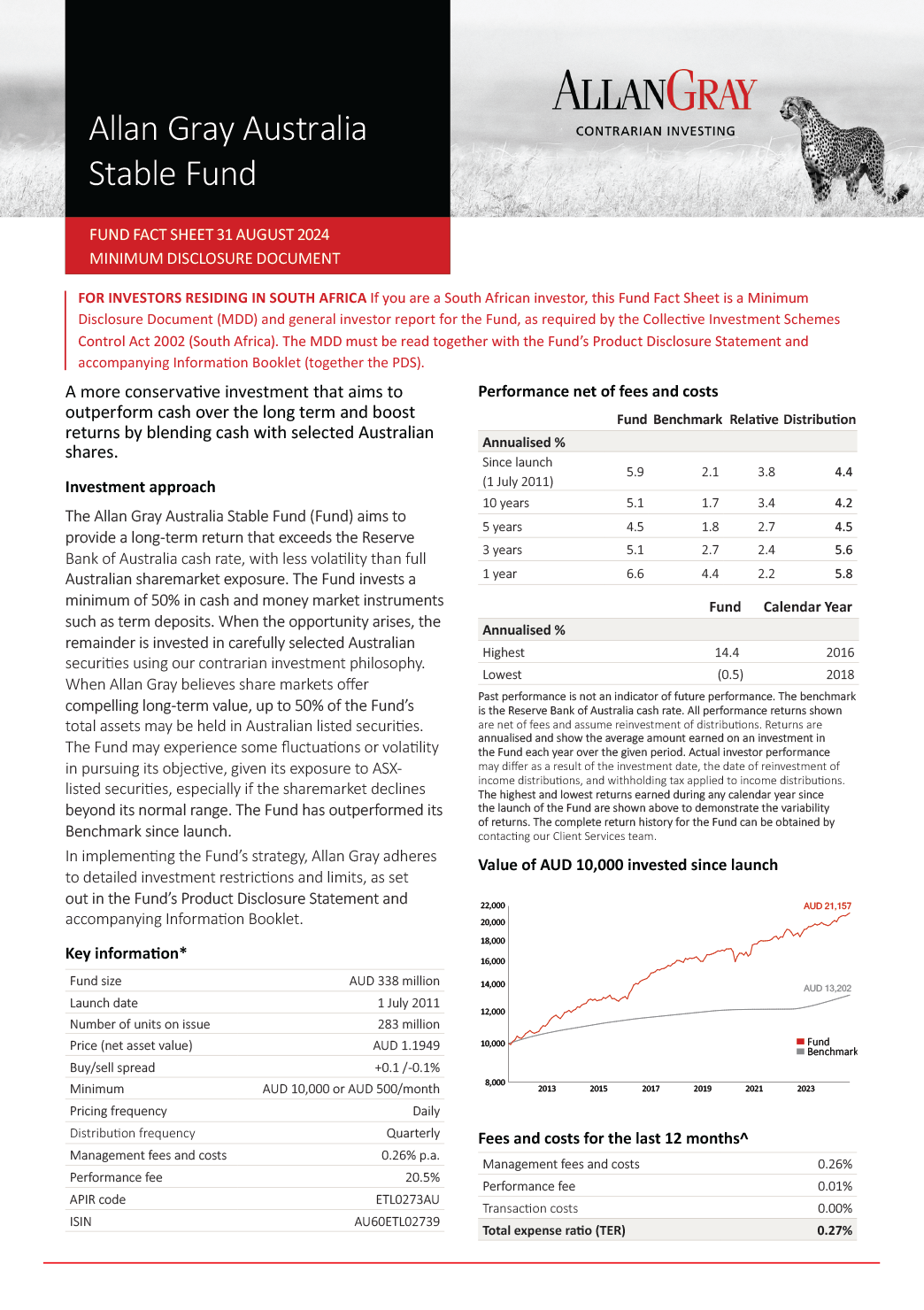

To meaningfully outperform cash, you need to be invested in growth assets but some investors don’t want the volatility that could come with full exposure to the sharemarket. That’s where the Allan Gray Australia Stable Fund could help.

Rather than holding complicated investments, its a simple fund that holds cash and money market instruments, and can invest in selected securities when we believe the opportunity is right – so the Fund aims to outperform cash over the long term without exposing you fully to the volatility of investing in securities alone.

Why choose the Allan Gray Australia Stable Fund?

Access the sharemarket with less risk

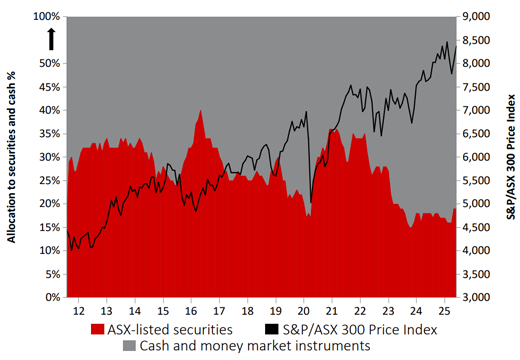

By investing predominantly in cash and money market instruments, with selected exposure to the sharemarket, the Fund may potentially outperform cash over the long term with less risk than investing in the sharemarket alone. Exposure to shares will never exceed 50% of the portfolio.

Not too complex

We don’t believe that outperforming cash should be complicated. This is why the Fund does not employ complex strategies such as long/short trading, options or derivatives. It simply invests in cash, term deposits and money market instruments and has limited exposure to selected domestic securities like shares.

A time-tested philosophy

Leverages our time-tested contrarian investment strategy in two ways. Firstly, we increase our exposure to shares when we see value and increase exposure to cash and money market instruments when we believe the market is running too hot. Secondly, the Stable Fund incorporates some of our contrarian share ideas that we use in our flagship Australian Equity Fund, which prioritises our long-term fundamental analysis.

Speak to our Client Services team

To learn more about our Funds, please do not hesitate to contact us directly by phone or email.

Investment management fees at a glance

As an investor in the Fund, you will pay a base fee of 0.26% p.a. and a performance fee of 20.5%. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee, the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high-water mark is in place to ensure that you only pay once for performance which exceeds the benchmark. The base fee and the performance fee (if applicable) are calculated and accrued daily and paid monthly. Goods and Services Tax, net of Reduced Input Tax Credit, is applicable to the base fee and the performance fee and are reflected accordingly. A schedule of fees and charges is available in the disclosure documents, and the latest total expense ratio can be found in the Fund fact sheet and Minimum Disclosure Document.

Risks of Investing

All investments carry risk. If you are considering the Allan Gray Australia Stable Fund, you should be aware that:

There is no guarantee your investment will do well

Please remember that we do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. In particular, past performance is not an indicator of future performance.

While we limit the Fund’s money market investments to those that are high quality, credit risk exists

If an issuer defaults on an investment, the Fund may suffer a loss of capital, interest or delay in repayment of capital. The market value of an investment can also fall significantly when the perceived risk associated with it increases or its credit rating declines.

You can find a comprehensive explanation of the risks in the Product Disclosure Statement (PDS), which should be read together with the Information Booklet and our Target Market Determinations, all of which can be found on our Forms and Documents page.