Welcome to Allan Gray Australia.

We want to ensure you get the right experience for you.

Individual Investors

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

Financial Advisers

The information contained in this section is for adviser and wholesale investor use only.

Retail Investors

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

The website is primarily designed for Australian investors.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Show investment objective, performance and more

Equity Fund - Class A

Going against human instinct and taking a contrarian approach to investing is not for everyone. It takes practice and commitment in your convictions. We use our fundamental research to uncover opportunities in areas that are overlooked or discarded by other investors.

We wait for the right opportunity to buy and give investments time for their value to be realised, as practising patience can be a distinct advantage over the long term. We bring this established investment philosophy to you through the Allan Gray Australia Equity Fund.

Why choose the Allan Gray Australia Equity Fund?

To benefit from a time-tested, contrarian investment approach

By investing for the long term, we look past the short-term market noise and wait patiently for a share’s value to improve. We believe bottom-up research is key to finding true value. We do not rely on macroeconomic forecasting or third-party research. Rather, our team of analysts undertakes its own rigorous research into each individual company to find hidden value.

To increase outperformance potential by investing differently

If you invest in the same shares as the majority of investors at the same time, it is by definition almost impossible to achieve different results. We look to buy shares when others are selling, and sell when others are buying. This gives us an edge, as we can face less competition and pay a lower price for shares that are out of favour with the broader investment community.

To improve the opportunity of upside

Taking a contrarian approach can improve your chance of paying a lower price and this can help you to achieve a better-than-average return when value is recognised by the market. By looking in unpopular areas of the market, we may find bargains, where excessive negative investor sentiment has created the opportunity to buy shares at a good price.

Speak to our Client Services team

To learn more about our Funds, please do not hesitate to contact us directly by phone or email.

Investment management fees at a glance

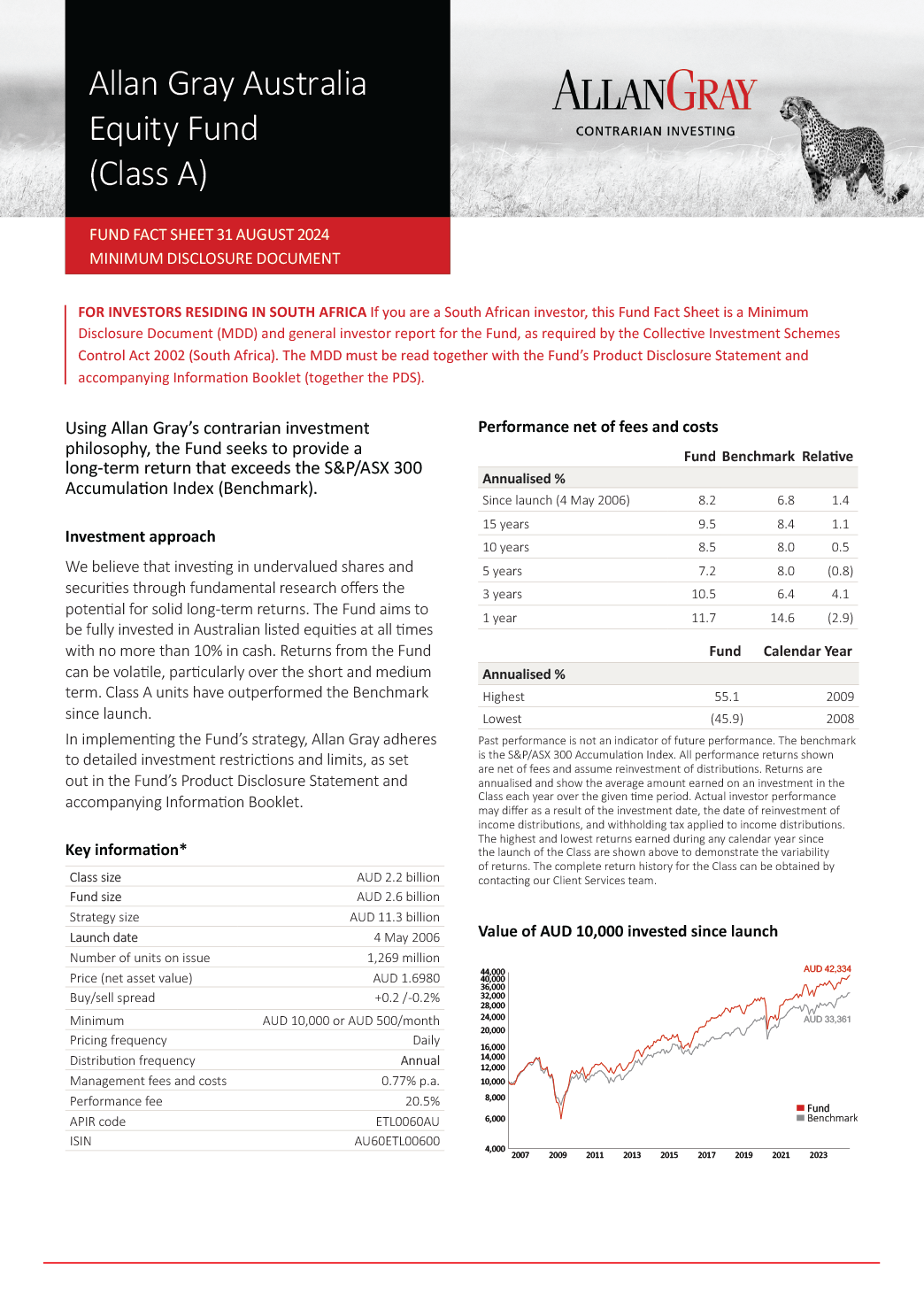

Investors in Class A units in the Fund will pay management fees and costs (base fee) of 0.77% p.a. and a performance fee of 20.5%. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee (if applicable), the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high-water mark is in place to ensure that you only pay once for performance which exceeds the benchmark. The base fee and the performance fee (if applicable) are calculated and accrued daily and paid monthly. Goods and Services Tax, net of Reduced Input Tax Credit, is applicable to the base fee and the performance fee and reflected accordingly. A schedule of fees and charges is available in the disclosure documents, and the latest total expense ratio can be found in the Fund fact sheet and Minimum Disclosure Document.

Risks of Investing

All investments carry risk. If you are considering the Allan Gray Australia Equity Fund, you should be aware that:

There is no guarantee your investment will do well

We do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. Past performance is not an indicator of future performance.

Markets can be volatile

The Fund will primarily hold Australian shares. As these investments can be volatile, your investment will fluctuate.

Individual shares can and often do fall in value

Individual shares can fall in value for many reasons including a company’s internal operations, actions by its management, its business environment and investor sentiment and responses.

You can find a comprehensive explanation of the risks in the Product Disclosure Statement (PDS), which should be read together with the Information Booklet and our Target Market Determinations, all of which can be found on our Forms and Documents page.