Welcome to Allan Gray Australia.

We want to ensure you get the right experience for you.

Individual Investors

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

Financial Advisers

The information contained in this section is for adviser and wholesale investor use only.

Retail Investors

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

The website is primarily designed for Australian investors.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Show investment objective, performance and more

Balanced Fund

Our Balanced Fund is designed to leverage our contrarian approach across equities and fixed income, depending on where we see opportunities, to drive long-term returns.

Your portfolio may benefit from a unique Balanced Fund with a wide mandate that gives us the flexibility to go against the consensus to drive results.

Why choose the Allan Gray Australia Balanced Fund?

Time-tested contrarian investment philosophy

Going against human instinct and taking a contrarian approach to investing is not for everyone. It takes true discipline and commitment in your convictions. The Fund leverages our time-tested contrarian investment strategy across a diversified portfolio and is benchmark unaware as we focus on long-term results.

A strong foundation

To reduce risk and generate higher long-term returns we aim to buy the right assets at the right price. Prioritising our long-term view in our fundamental analysis gives us a competitive edge that may enable us to deliver better outcomes.

Expertise

This Fund combines Allan Gray Australia’s domestic specialisation with Orbis Investment’s global markets expertise.

Performance driven with the flexibility to adapt

While the Fund offers a broad investment mix to balance risk, its focus is to drive performance. We can vary the Fund’s exposure to different asset classes depending on where we find value, the potential for capital growth and income and risk of loss. This flexibility helps us drive long-term returns while seeking to reduce the impact of major market falls.

Speak to our Client Services team

To learn more about our Funds, please do not hesitate to contact us directly by phone or email.

Investment management fees at a glance

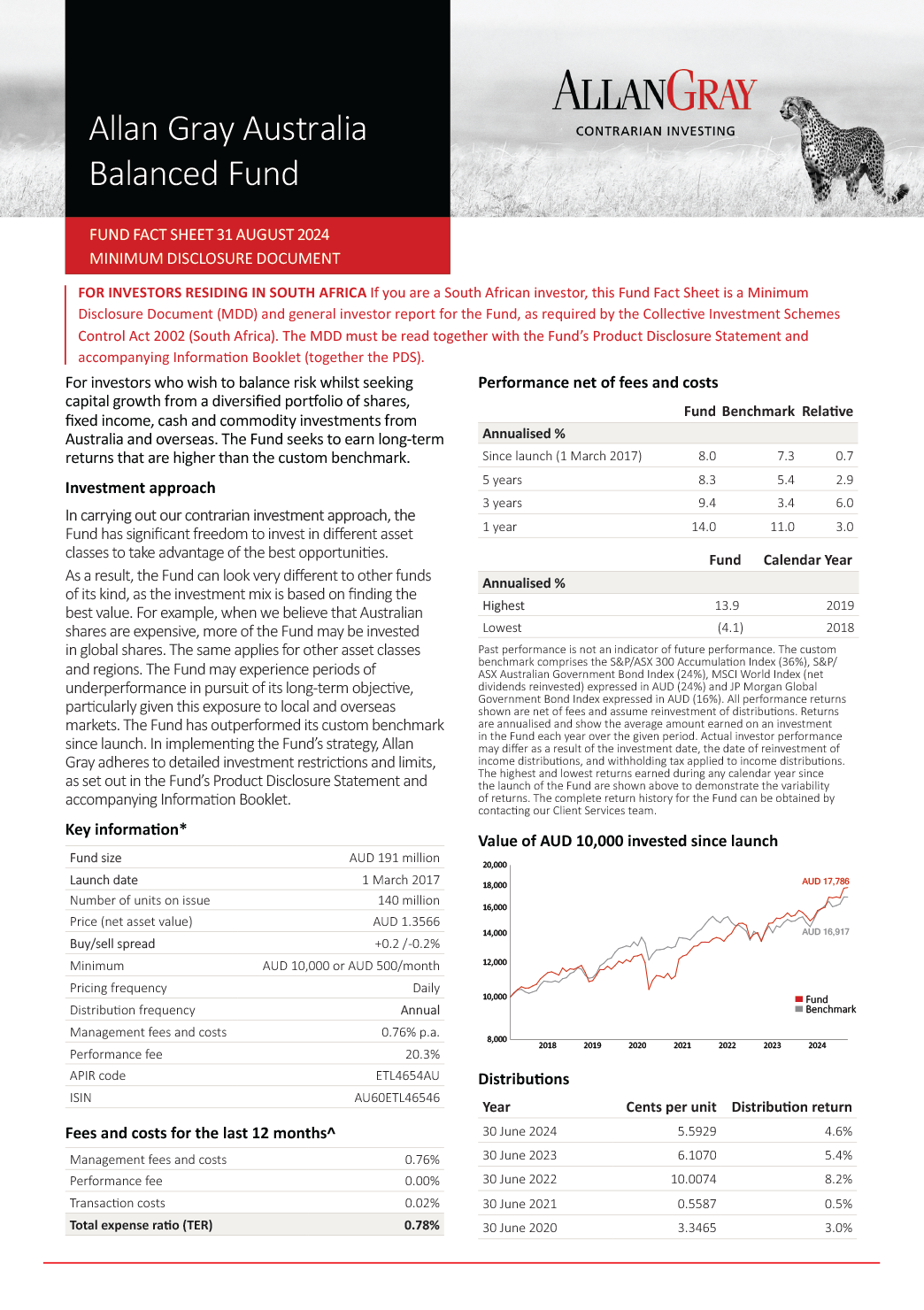

As an investor in the Fund, you will pay a base fee of 0.76% p.a. and a performance fee of 20.3%. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee (if applicable), the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high-water mark is in place to ensure that you only pay once for performance which exceeds the benchmark. The base fee and the performance fee (if applicable) are calculated and accrued daily and paid monthly. Goods and Services Tax, net of Reduced Input Tax Credit, is applicable to the base fee and the performance fee and are reflected accordingly. A schedule of fees and charges is available in the disclosure documents, and the latest total expense ratio can be found in the Fund fact sheet and Minimum Disclosure Document.

Risks of Investing

All investments carry risk. If you are considering the Allan Gray Australia Balanced Fund, you should be aware that:

There is no guarantee your investment will do well

We do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. Past performance is not an indicator of future performance.

Markets can be volatile

The Fund will primarily hold Australian and international shares and bonds. As these investments can be volatile, your investment will fluctuate. In addition, some of the markets in which the Fund invests may be considered emerging markets, which carry their own risks such as political and social instability.

Currency movements will impact performance

Although a large portion of the Fund will be held in Australian assets, fluctuations in exchange rates can have a significant influence on the Fund’s international investments and could impact overall returns.

You can find a comprehensive explanation of the risks in the Product Disclosure Statement (PDS), which should be read together with the Information Booklet and our Target Market Determinations, all of which can be found on our Forms and Documents page.