Livewire Live – content round-up

On 9 September 2025, some of Australia’s most experienced professional investors assembled to debate critical …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

To aim to achieve returns that exceed inflation over time, investors need to be invested in growth assets. However, we also understand it’s not easy to remain invested during periods of market volatility. This is where the Allan Gray Australia Balanced Fund can help, as it provides a diversified investment that is professionally managed on investors’ behalf.

To aim to achieve returns that exceed inflation over time, investors need to be invested in growth assets. However, we also understand it’s not easy to remain invested during periods of market volatility. This is where the Allan Gray Australia Balanced Fund can help, as it provides a diversified investment that is professionally managed on investors’ behalf.

A diversified managed fund, such as a balanced fund, enables investors to invest in just one one fund that holds a mix of asset classes, like shares, fixed income, and cash. By offering exposure to different assets, investors benefit from inbuilt risk management as diversification helps spread risk and can reduce the impact of poor performance in any one asset class. This simplicity may be particularly appealing to investors who may not have the time, expertise, or inclination to actively manage multiple investments. Furthermore, investors are likely to benefit from having experienced investment professionals manage the total portfolio – investors effectively outsource their investment decisions to experts who are consumed by investing.

It’s important for investors to carefully assess their financial goals, risk tolerance, and investment time horizon before choosing any investment, including balanced funds. Additionally, the specific objectives and strategies of balanced funds can vary, so investors should review fund documents and disclosures to understand how a particular fund is managed.

As contrarian investors, we don’t follow the herd and our balanced fund is no different. Our wider group has been managing balanced portfolios since 1999, and we brought this experience to the Australian market with the launch of the Allan Gray Australia Balanced Fund in 2017. This Fund combines Allan Gray Australia’s domestic specialisation with Orbis Investment’s global markets expertise, giving investors access to two specialist teams to manage Australian and Global securities.

The features that really set us apart from other balanced funds include:

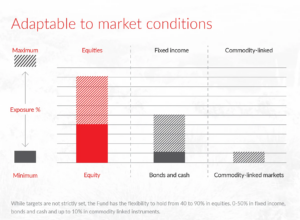

Balanced funds usually offer a broad investment mix to reduce risk. We do too – but we’re more focused on performance, as it’s long-term returns that grow an investor’s wealth. That’s why our Fund is not restricted to particular global markets or industries. We can also vary the Fund’s exposure to different asset classes depending on where we find value, the potential for capital growth and income, and risk of loss. It’s this flexibility to adapt to changing market conditions that helps us drive long-term returns while reducing the impact of major market falls.

We do not believe balanced funds should begin with the opinions of an economist who attempts to predict the future by taking a broad macroeconomic view of the world. Whilst this often makes for great conversations, attempting to predict the future is fraught with danger. We believe that in order to generate higher long-term returns you must buy the right assets at the right price.

Prioritising our long-term view in our fundamental analysis itself gives us a competitive edge that allows us to deliver better outcomes for investors. We focus on trying to understand an asset’s underlying intrinsic value, the drivers that determine this, and the gap between this value and the price you can buy it for. This gap – known as a margin of safety – serves to reduce investor risk and helps generate long-term returns.

To learn more about the Allan Gray Australia Balanced Fund, please visit our Fund page, or speak to our Client Services team.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.