Welcome to Allan Gray Australia.

We want to ensure you get the right experience for you.

Individual Investors

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

Financial Advisers

The information contained in this section is for adviser and wholesale investor use only.

Retail Investors

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

The website is primarily designed for Australian investors.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

How can we drive better long-term outcomes?

With the recent rise in popularity of managed accounts, you may be forgiven for thinking that the traditional diversified managed fund is a product of yesteryear. We, however, believe the role of these funds is more pressing than ever before and when held alongside or within a managed account, the result is potentially better client outcomes.

To learn more, read our discussion paper, explore recent media articles and find out how the Allan Gray Australia Balanced Fund leverages our contrarian approach to drive long-term returns.

Meet the experts

Hear directly from the Allan Gray Australia Balanced Fund’s managers, our MD & CIO Simon Mawhinney and Orbis Investment Director and Portfolio Manager Alec Cutler. This dynamic duo starts with a Fund overview, then from 7 to 11 minutes they get into portfolio positioning, how we’re navigating today’s tricky investment landscape and what’s been driving the Fund’s recent strong performance.

Download Brochure

Editorial insights on Balanced Portfolios

See media coverage

Back from the dead?

Professional Planner

Why diversified managed funds could lead to better results.

Allan Gray Australia Investment Specialist, Chris Hestelow, speaks to Professional Planner and discusses why we believe the role of diversified managed funds is more important than ever and could potentially lead to better client outcomes.

The client comes first

Professional Planner

Designing a multi-asset portfolio to maximise client outcomes.

We believe there is a role for diversified funds in almost any multi-asset portfolio and will not only reduce the risk of having all clients in a single investment approach, but it could also potentially lead to better client outcomes as well.

Maximising outcomes

Money Management

Maximising client outcomes with multi-asset portfolios

Here we speak to Money Management and discuss why diversified managed funds could make an ideal addition to a managed account, as the broad toolset available to the fund manager allows them to seek outperformance and manage risk.

Deserving of a place

Money Management

Why diversified managed funds deserve a place in client portfolios

The number of advisers using managed accounts has exploded in recent years, often at the expense of diversified managed funds. But diversified managed funds deserve a place in almost any multi-asset portfolio, held either within or alongside a managed account, according to Allan Gray.

The five keys

Allan Gray insights

Five keys to managing a balanced fund

We believe a diversified managed fund has a broader toolset available with which to manage risk and seek outperformance. Here we outline our view on the five key elements essential to managing a successful diversified managed fund.

Watch

Money Management

Tune in to this episode of Money Management’s Meet the Manager where our Chris Hestelow discusses why diversified managed funds are a great tool for advisers looking to diversify client portfolios and can be a great complement to a managed account structure.

Why should the Allan Gray Australia Balanced Fund be part of your client portfolios?

The Fund prioritises bottom-up analysis instead of broad macroeconomic views that makes other balanced funds similar.

Many advisers are using our Balanced Fund to diversify their clients’ balanced allocations and the inclusion of our Fund brings true diversification with a contrarian difference.

Our Fund is performance driven with the flexibility to adapt by having a wider mandate than many of our competitors. We are not restricted to particular global markets or industries.

The Fund leverages our time-tested contrarian investment strategy across a diversified portfolio. We are benchmark unaware, as we focus on long-term results.

This Fund combines Allan Gray Australia’s domestic specialisation with Orbis Investment’s global markets expertise.

Check out our dedicated adviser product page for more Balanced Fund information.

Take the next step

Call

Don’t hesitate to reach out to our Relationship Management team or call our Client Services Team with any questions you have.

Call 1300 604 604 or email at clientservices@allangray.com.au

Watch

Our Balanced Fund is designed to leverage our contrarian investment approach. In this video, you will learn about how we construct the Fund and how your client portfolios could benefit from a unique mandate that gives us the flexibility to go against consensus to drive results.

Download

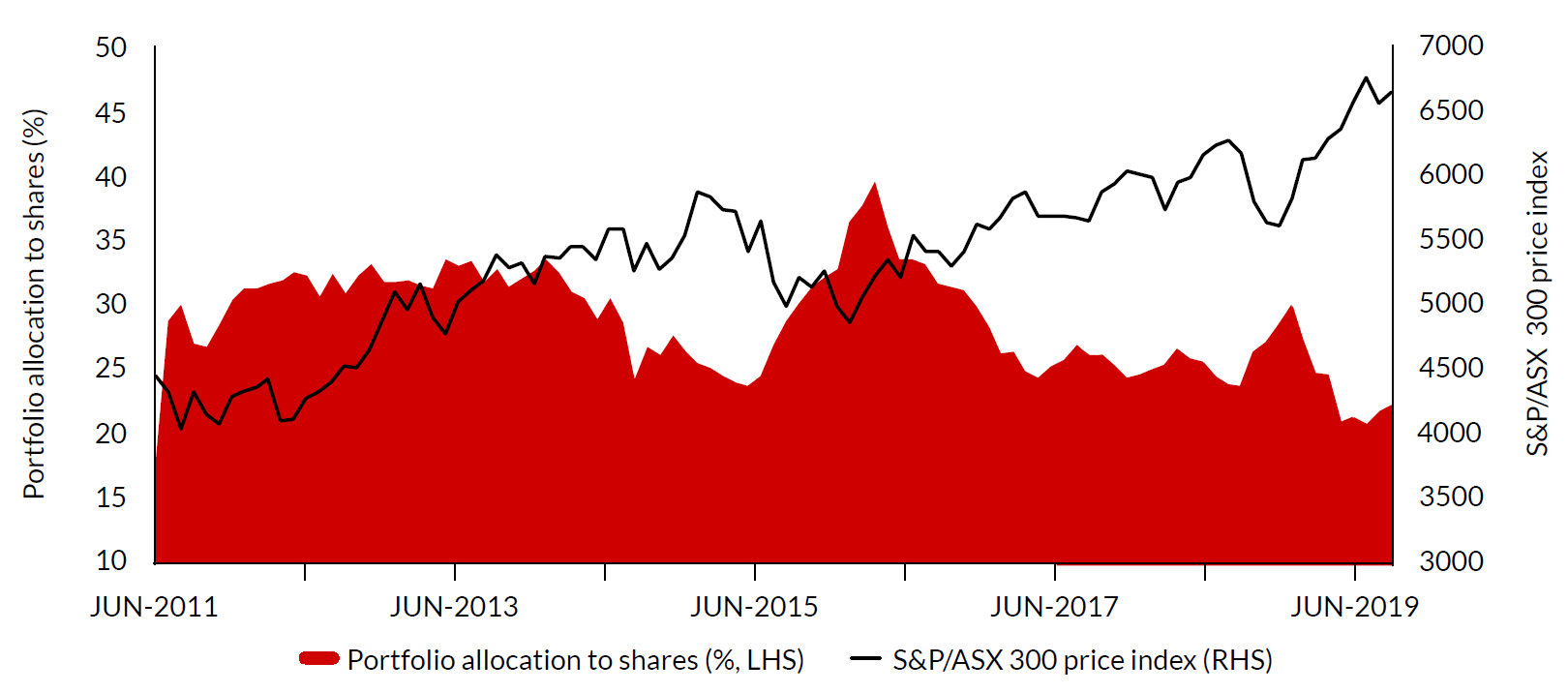

Download our latest Fund Fact Sheet to see performance, asset allocation, largest holdings, geographical allocation, fees and other key information.