Livewire Live – content round-up

On 9 September 2025, some of Australia’s most experienced professional investors assembled to debate critical …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

In this extract from the June 2020 Quarterly Commentary, Julian Morrison, CFA, Head of Research Relationships and National Key Accounts, reviews the performance of the Allan Gray Australia Funds. Click here to read the full Quarterly Commentary.

In this extract from the June 2020 Quarterly Commentary, Julian Morrison, CFA, Head of Research Relationships and National Key Accounts, reviews the performance of the Allan Gray Australia Funds. Click here to read the full Quarterly Commentary.

The Australian sharemarket rebounded strongly in the June quarter, with the S&P/ASX 300 Accumulation Index gaining 16.8%. The Allan Gray Australia Equity Fund (Class A) outperformed its S&P/ASX 300 Index benchmark by 1.5% during the quarter.

The June quarter saw some reversal in trends that have been a headwind to our portfolio previously. Notably, strength in the Energy sector made our overweight position in Energy a strong positive for relative performance. Within that sector, Oil Search Limited was the largest contributor at the stock level.

The quarter also saw weaker relative performance for the Healthcare sector. Consequently, the absence of Healthcare exposure in the Fund was another significant positive. Exposure to Financials was positive overall for relative performance, with a meaningful position in AMP Limited being the largest positive driver at a stock level within the Financials sector.

The worst performing sector for the Fund was Consumer Staples, due to the holding in Metcash Limited. We had reduced exposure to this stock on the extreme strength of the first quarter and we remain comfortable with the current holding.

Performance from the Materials sector was negative overall, with Nufarm Limited, Incitec Pivot Limited and Alumina Limited all detracting from relative performance. But it was not entirely one-sided. Our largest holding in the sector, Newcrest Mining Limited, was also the largest positive contributor of all stocks held in the portfolio.

Cyclically-exposed sectors and companies remain key positions in the Fund currently. Notwithstanding some bright spots this quarter, it is our opinion that they still offer significantly greater value and price upside than the more stable earners (staples, utilities, healthcare) and disruptors (technology companies) which appear to trade at blue-sky valuations. Our portfolio remains firmly skewed away from healthcare, staples and technology, having used recent strength to sell almost entirely the positions we had in those sectors (such as Coles and Telstra) and invest the proceeds in a number of, in our opinion, very cheap but cyclically-exposed companies currently experiencing earnings headwinds.

The Allan Gray Australia Balanced Fund outperformed its composite benchmark by 1.7% for the June quarter.

The Fund had 70% in shares at quarter end, although about 7% of the global share exposure is reduced through the use of exchange-traded derivatives which allows for some protection in those periods when market indices fall. The Fund has been overweight global shares versus global fixed income. This contributed strongly to relative performance for the quarter, as global shares outperformed fixed income. In addition, stock selection in both the Australian and global shares further bolstered relative returns.

The Fund, on average, held 25% in fixed income securities and cash during the quarter. This has remained significantly shorter in duration than the benchmark – at one year versus eight for the benchmark. This had limited impact on the Fund for the June quarter, with government bond yields fairly flat, on average, during the quarter. The Fund remains more defensively positioned than the benchmark in terms of both relative and absolute returns, in the event interest rates rise.

The Allan Gray Australia Stable Fund outperformed its cash rate benchmark by 4.9% in the June quarter.

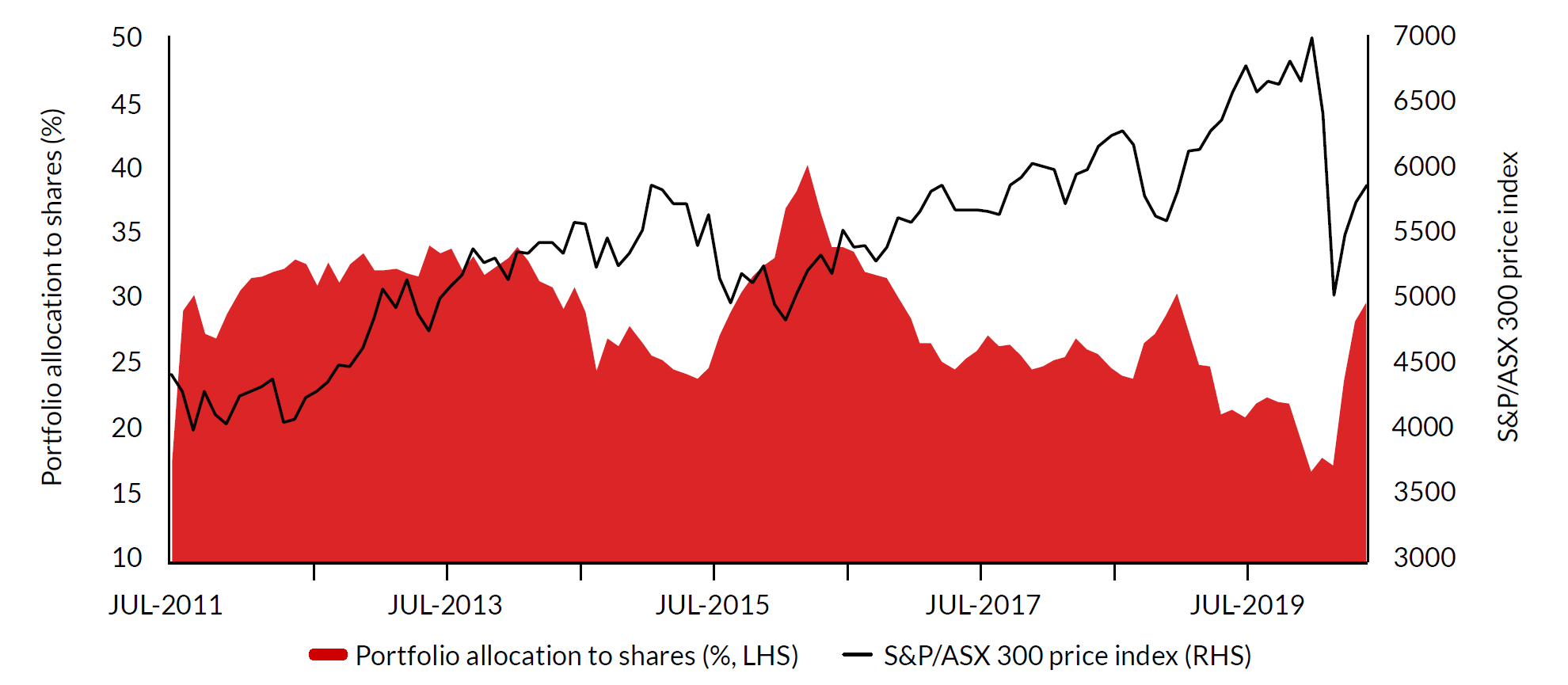

The performance of the Stable Fund is driven by the performance of our favoured Australian share holdings and the decision on how much is invested in shares versus cash. The Fund benefited from having built increased exposure to shares during the weakness of the first quarter, and this continued to increase selectively during the second quarter.

As at the end of June, the Fund had around 30% invested in shares, with the remainder in cash and money market investments. This can be seen in the graph below, which shows our allocation between cash and shares over time.

The broad Australian sharemarket is still some way from its previous high. However, the market average fails to highlight that some popular stocks and sectors are priced at levels that in our view are far too optimistic. We therefore remain focused on avoiding those areas and the risks that come with excessive valuation. Instead, the shares held in the Fund will be those we have assessed as most attractively priced and where risk of permanent capital loss is low.

Source: Allan Gray Australia, Bloomberg, as at 30 June 2020.

Julian Morrison holds a Bachelor of Arts (Honours – University of Sheffield) and the Chartered Financial Analyst designation.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.