Livewire Live – content round-up

On 9 September 2025, some of Australia’s most experienced professional investors assembled to debate critical …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

In this extract from the December 2019 Quarterly Commentary Julian Morrison reviews the Allan Gray Australia Funds over the last quarter. Click here to read the full Quarterly Commentary.

The Australian sharemarket was up 0.7% for the fourth quarter, with a strong November keeping the broad market in positive territory, despite weakness at both the start and end of the period.

The Allan Gray Australia Equity Fund (Class A) underperformed its S&P/ASX 300 Accumulation Index benchmark by 1.2% for the last quarter, largely due to a weak month in October. The Class did recoup some of this, outperforming for the last two months of the quarter.

The largest detractor from performance for the quarter was Newcrest Mining, which was weak throughout the quarter. Another large factor in the underperformance was the absence of Healthcare exposure – a sector that continued to perform strongly, but where we continue to believe valuation risk remains high in general.

Positive contribution to performance came in the form of our underweight exposure to Financials, as well as stock selection within that sector. Our overweight exposure to Energy was also a positive factor, with Woodside Petroleum and Origin Energy both adding to relative performance. As 2020 begins with renewed global uncertainty, and the broad Australian sharemarket near all-time highs, we believe the value potential inherent in our energy, gold and other contrarian exposures remains significant.

The Allan Gray Australia Balanced Fund outperformed its composite benchmark by 2% in the fourth quarter. The Fund has 68% in equities, though about 7% of the global share exposure is hedged, which allows for some protection in those periods where market indices fall. The Fund has been underweight Australian equities and overweight global equities. This bolstered relative performance for the quarter, as global equities outperformed Australian. In addition, stock selection in the global component further helped relative returns.

For the approximately 22% of the portfolio currently invested in fixed income, we remain significantly shorter in duration than the benchmark – at below two years versus seven for the benchmark. This has detracted from relative performance for some time in an environment of falling interest rates. However, the last quarter saw a slight reversal of this, with 10-year bond yields rising both in Australia and the US. This was a positive for the Fund, which remains more defensively positioned than the benchmark in terms of both relative and absolute returns, in the event interest rates rise.

The Allan Gray Australia Stable Fund outperformed its cash rate benchmark by 0.4% in the fourth quarter.

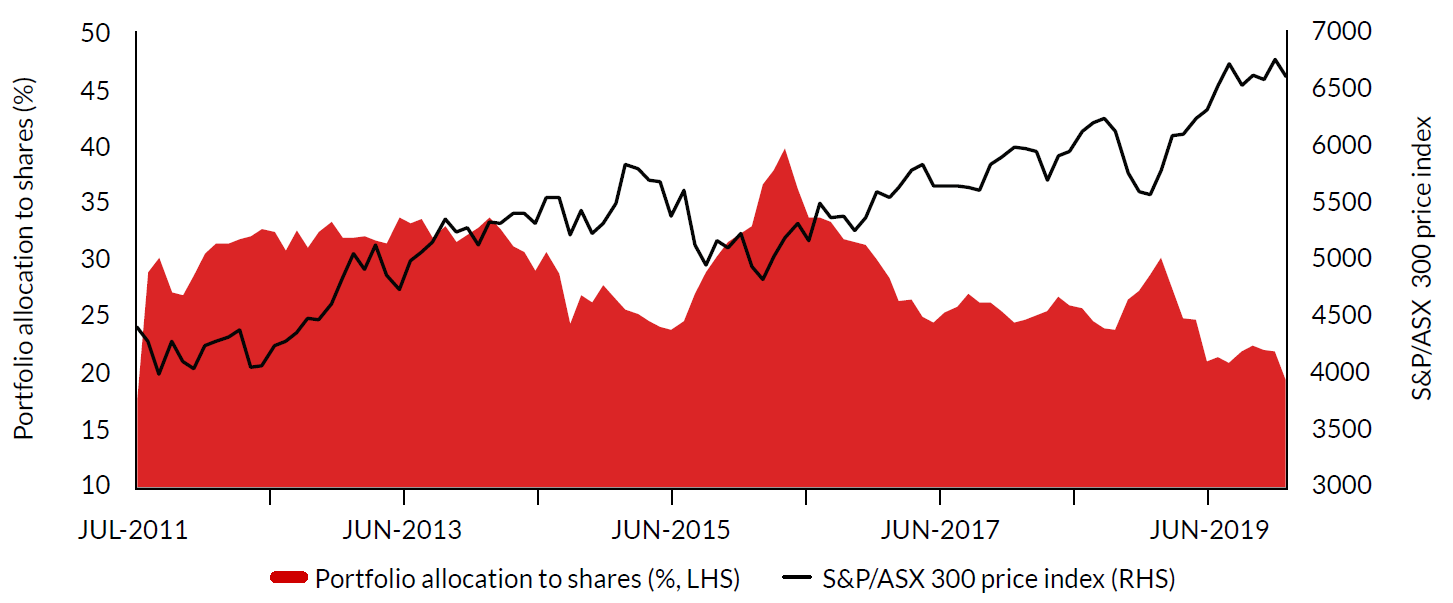

The performance of the Stable Fund is driven by the performance of our favoured Australian share holdings and the decision on how much of the portfolio is invested in shares versus cash. The exposure to shares can range from zero to 50% of the Fund and the allocation over time is illustrated in the red shaded area in Graph 3. As the sharemarket has risen strongly over the course of the last year, we have reduced the Fund’s overall exposure to shares. At the end of the fourth quarter, exposure to selected shares remains near the lowest in the history of the Fund at around 20%. We continue to focus these holdings in out-of-favour shares, such as Woodside Petroleum, Newcrest Mining and Sims Metal Management, where we believe the price is not reflective of their value and which therefore offer some defensive qualities in a potentially expensive overall market.

Source: Allan Gray as at 31 December 2019

Julian Morrison holds a Bachelor of Arts (Honours – University of Sheffield) and the Chartered Financial Analyst designation.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.