Livewire Live – content round-up

On 9 September 2025, some of Australia’s most experienced professional investors assembled to debate critical …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Quarterly Fund Review – June 2021

Quarterly Fund Review – June 2021 In this extract from our June 2021 Quarterly Commentary, Julian Morrison, CFA, our Head of Research Relationships and National Key Accounts, reviews the performance of the Allan Gray Australia Funds. Click here to read the full Quarterly Commentary.

The Australian sharemarket had a strong quarter to June, with the S&P/ASX 300 Accumulation Index up 8.5% for the quarter. The Allan Gray Australia Equity Fund returned 0.5% during the same period, underperforming its S&P/ASX 300 benchmark by 8%.

The June quarter saw investor preferences return to the extremes of recent years, after a brief hiatus, pushing various market darlings to even more overpriced levels. At the same time, out-of-favour companies (many of them cyclically-exposed) are being shunned and remain amongst the most attractive opportunities, in our opinion.

After contributing strongly in the previous two quarters, the Fund’s overweight positions in the Materials and Energy sectors were the largest detractors from relative returns from a sector perspective during the June quarter. Within Materials, the Fund’s exposure remains very different from the benchmark. Incitec Pivot, Alumina and Newcrest Mining were amongst the largest detractors. We added to these positions over the quarter as lower prices presented buying opportunities. Elsewhere in the Materials sector, recycling company Sims bucked this trend and we lightened our holding on its recent strength.

Energy companies such as Woodside Petroleum, Oil Search and Origin Energy have remained undervalued and, therefore, appealing in our opinion. We have also added to some of these on recent underperformance.

The Financials sector also detracted from performance overall for the quarter. Among the underperformers were AMP and ANZ, which we continue to view as offering good value. QBE was one of the Fund’s larger financial holdings that performed very strongly. We took advantage of higher prices in QBE and other strong performers, and the successful takeover of hygiene company Asaleo Care, to fund opportunities in more depressed names.

We believe recent years have seen extremes in both investor behaviour and dispersion between loved and unloved shares. This remains the case today and presents unusually significant risk, and opportunity, of a shift in future outcomes versus current expectations – the risk of overpaying and the opportunity to underpay. To paraphrase the late economist Rüdiger Dornbusch:

“The [shift] takes a much longer time coming than you think, and then it happens much faster than you would have thought.”

We acknowledge that we reiterate our focus on valuation and patience at the risk of sounding boring to our investors. But we find that immeasurably preferable to the alternative – capitulating on that discipline and risking permanent loss of capital. We see significant latent unrealised value in the Fund versus the market, and thus remain optimistic regarding future long-term prospects.

The Allan Gray Australia Balanced Fund returned 2.3% for the quarter, underperforming its composite benchmark by 3.9%.

While the overall allocation to shares contributed positively to absolute performance, stock selection in both Australian and global shares detracted from relative returns.

The Fund had 68% in shares at quarter-end. This is after accounting for about 7% of the global share exposure being reduced through the use of exchange-traded derivatives, which allows for some protection in those periods where market indices fall.

The Fund held around 20% in fixed income securities and a 5% exposure to gold through an exchange-traded fund at quarter-end. The fixed income allocation has remained significantly shorter in duration than the benchmark – at below two years versus almost eight years for the benchmark. This means the fixed income holdings will not perform as well as the benchmark when government bond yields fall – and this was the case in the June quarter.

However, it also means that the fixed income portion of the Fund remains more defensively positioned than the benchmark (in terms of both relative and absolute returns), in the event that interest rates rise from current historically low levels.

As with the Equity Fund, we believe potential portfolio value relative to the market is significant and we continue to manage for risk with a long-term, valuation-driven perspective.

The Allan Gray Australia Stable Fund returned -0.1% for the quarter, underperforming its RBA cash rate benchmark by 0.1%.

The performance of the Stable Fund is driven by the performance of our favoured Australian share holdings and the decision on how much is invested in shares versus cash. The broad Australian sharemarket has risen strongly for three consecutive quarters now and reached all-time highs in June. The Fund took advantage of the recent strength to lighten some of our stronger-performing positions.

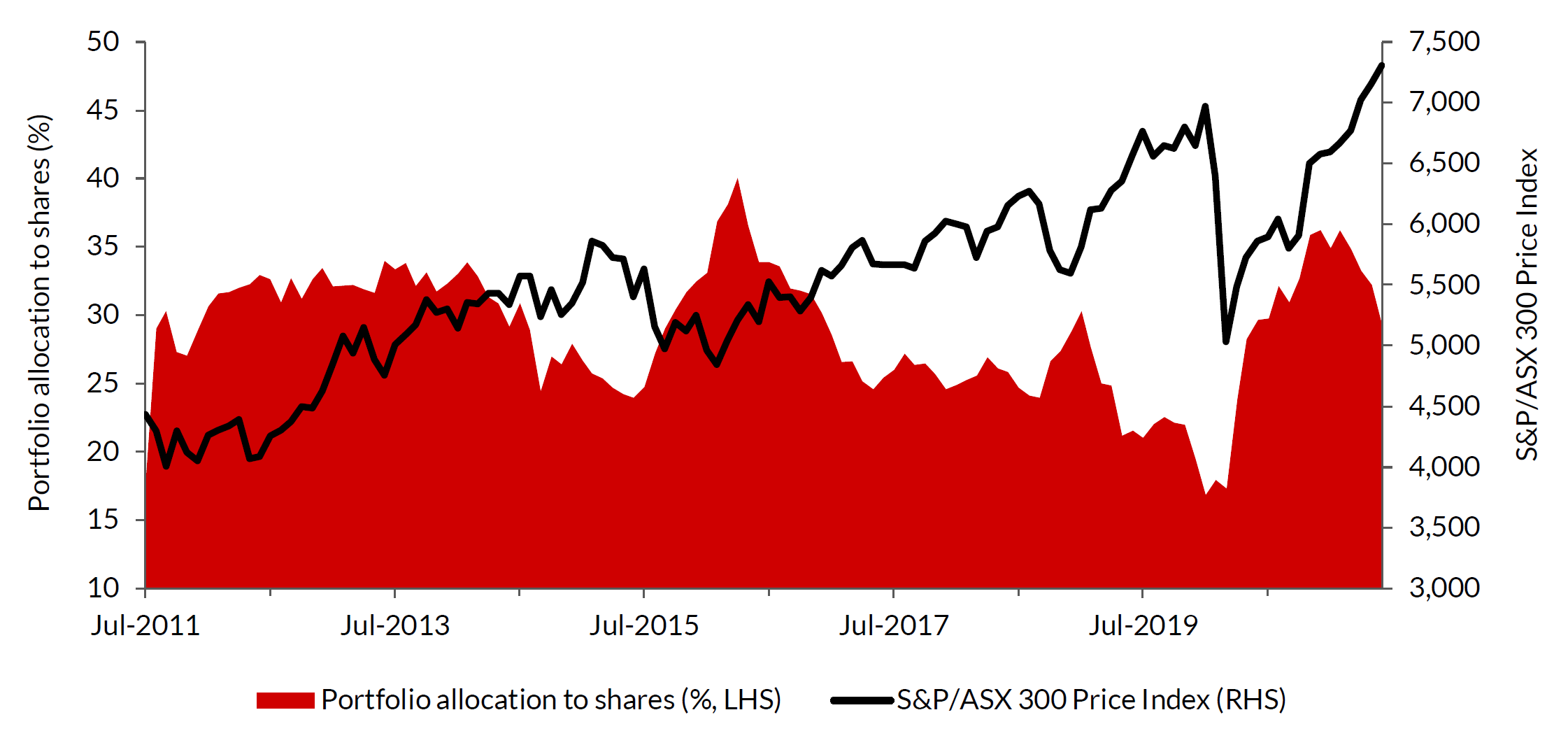

At the end of June, the Fund had around 29% invested in ASX-listed securities, versus around 35% at the end of the previous quarter. The remainder is held in cash and money market investments. This can be seen in the graph below, which shows our allocation between cash and shares over time.

The extreme strength in the sharemarket during the June quarter fails to highlight the significant divergence that has built up over time between different categories of shares. Some popular shares and sectors are priced at levels that in our view are far too optimistic. We therefore remain focused on avoiding those areas and the risks that come with excessive valuation. Instead, the shares held in the Fund will be those we have assessed as most attractively priced, where we see the risk of permanent capital loss to be lower.

Source: Allan Gray, Bloomberg, as at 30 June 2021.

Julian Morrison holds a Bachelor of Arts (Honours – University of Sheffield) and the Chartered Financial Analyst designation.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.