The dynamic duo – video

How we’re navigating markets and powering returns The Allan Gray Australia Balanced Fund continues to …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

In this extract from our March 2025 Quarterly Commentary, we dig into one of the Allan Gray Australia Equity Fund holdings, Ramsay Health Care Limited, and discuss the thesis behind our investment. Download the full Quarterly Commentary here.

Our performance has been good over the quarter. For whatever reason, the market appears to be shifting its focus to the underlying fundamentals that drive value and placing less emphasis on optimistic assessments of hard-to-predict futures. Were this to continue, it would be a significant change from the trend of the past 15 or so years and should bode well for our fundamental investment style. But that’s the extent of the navel gazing we can muster and this commentary is focused on Ramsay Health Care Limited.

Tim Hillier, Analyst, digs into Ramsay Health Care below and explains the thesis behind our investment.

Ramsay owns and operates private hospitals and healthcare facilities, where it provides a range of medical services including surgery, rehabilitation, psychiatric care and general medical care.

Its network comprises 76 hospitals and clinics in Australia, 34 in the UK, and 244 in Europe (via its 52% ownership of Ramsay Santé), as shown in Figure 1. Ramsay also owns Elysium, which operates 84 mental health and rehabilitation facilities in the UK.

Ramsay is responsible for providing patients with access to healthcare, as well as managing and maintaining wards, procedure rooms and essential support services. The company’s workforce includes nursing, catering, maintenance and administrative personnel, with staff wages representing the largest operational expense.

Most doctors maintain independent practices and charge patients (or their insurers/payers) directly for their services.

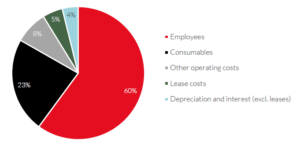

Ramsay also incurs costs for medical consumables, overheads and rental of any leased facilities. Ongoing capital investment is also required to sustain the business. Ramsay charges for these services based on contracts or tariffs that reflect the complexity and duration of care provided. Ramsay’s operating costs are shown in Graph 1.

In Australia, private health insurers generally pay Ramsay for a patient’s care. Ramsay agrees new multi-year contracts with these insurers periodically. In France and the UK, governments or national health insurance pay for most of the care Ramsay provides. Those governments determine tariffs to reimburse the hospitals for the procedures they perform, with adjustments made on an annual basis.

Source: https://www.ramsayhealth.com, December 2024.

Over the last five years, private hospitals have faced rapid and unexpected cost inflation that they have been unable to recover from insurers or public payers. Contracts with insurers, typically spanning three years, were based on lower project inflation. Governments, meanwhile, were unwilling to adjust tariffs sufficiently to compensate hospitals for higher costs.

In Australia, average earnings before interest, taxes, depreciation, and amortisation (EBITDA) margins for a large sample of private hospitals fell from 8.7% in 2018 to 4.4% in 2022¹. During this period, costs grew 4.1% p.a. while revenues grew only 2.9% p.a.

Source: Ramsay Health Care, Allan Gray Australia, March 2025.

The economics have declined even more than the fall in EBITDA would suggest. EBITDA is now calculated before the cost of leases². For Ramsay, lease costs are 5% of revenues, but Ramsay owns many of its hospitals, and the cost would be somewhat higher for an operator that did not own hospitals. EBITDA is also before maintenance capex, a real cost in all asset-intensive businesses that has also increased significantly since 2018.

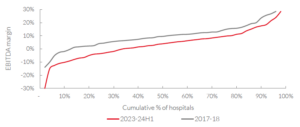

If we account for both of these factors, we believe EBITDA margins of over 10% are required for many hospitals to break even. Graph 2 shows the distribution of EBITDA margins for a sample of 243 private hospitals in Australia. In 2018, 50% of this sample had an EBITDA margin below 10%. By 2024, 75% of private hospitals were below 10%.

Source: Department of Health – Private Hospital Financial Viability Health Check November 2024, Allan Gray Australia.

The situation is also dire in the UK and even more dire in France, where government-mandated tariffs have also failed to keep pace with cost inflation. In 2024, Ramsay Santé lost €53.9 million (m) and Ramsay’s acute hospitals in the UK were only marginally profitable. In France, despite being a return seeking endeavour, grossly inadequate government funding has made Ramsay Santé an unsustainable essential services charity.

The heart of Ramsay’s business is its high-quality Australian hospital portfolio. This portfolio is largely the product of several astute acquisitions in the early 2000s.

However, from 2010 to 2022, Ramsay spent $5 billion (b) on a series of acquisitions in Europe and the UK that were not nearly as good. These operations contributed only $100m of EBIT in the 2024 calendar year (CY24), a paltry 2% return on their investment. In fairness to Ramsay, these earnings have been impacted by the factors outlined above and so are hopefully at a cyclical low.

One of Ramsay’s more questionable acts of capital allocation lunacy took place in 2023 with the $1.5b Elysium acquisition. Elysium was purchased from private equity at what we see as a high multiple of inflated earnings, a textbook case of a self-inflicted harm.

Today we pay 26 times Ramsay’s expected earnings for the financial year ending June 2025. At face value this may not seem cheap, but we believe these earnings to be low and attractive long-term fundamentals for private hospitals should result in significantly higher future earnings.

Three things are worth bearing in mind when considering Ramsay’s future earnings:

1. Private hospital operations are currently unsustainable. For example, Australia’s second largest operator, Healthscope, was unable to pay its March rent in full, and its debt is trading at a steep discount to face value. Aside from the troubles at Healthscope, there have been several other hospital closures. More funding is required for the private hospital sector in Australia. Although an already announced 3.73% increase in regulated health insurance premiums for 2025 will help, a more equitable split of profits within the healthcare sector is long overdue. Australia’s largest private health insurer, Medibank, made an impressive 25.4% return on equity in CY24³, as shown in Graph 3. This is high for a regulated industry and while it is not materially higher than pre-COVID-19 levels, it is meaningfully better than returns on offer from the private hospital sector.

In Europe and the UK, low tariffs might provide governments with short-term budgetary benefits, but this is unlikely to work as intended in the long-term. Private hospitals supplement public healthcare efficiency, making sustainable funding a sensible strategy to improve healthcare delivery and, in all likelihood, to reduce the overall cost of the healthcare system.

Source: Medibank, Allan Gray Australia, March 2025.

2. Long-term fundamentals of the private hospital industry are healthy, thanks in part to a growing and ageing population. For example, Australia’s over-65 population is projected to increase by 30% by 2034. This demographic’s healthcare needs are higher than younger demographics, with double the hospitalisation rate and longer stays. Existing demand is already going unmet, as evidenced by growing public waitlists. In the UK, where Ramsay primarily serves National Health Service patients, the waitlist increased from 2 million patients in 2010 to 7.5 million patients in 2024.

Normally industries that have promising growth prospects attract strong supply responses, which erode returns. The reverse is true here. There is currently no incentive for private capital to build new capacity. Rather, hospitals are closing and many face economic threats.

3. Ramsay’s valuation is underpinned by its high-quality wholly owned hospital portfolio. Ramsay owns 48 of the 72 hospitals in its 9,300-bed Australian network. As the cost of a new 100-bed acute hospital is well over $150m today, the intrinsic value of Ramsay’s portfolio accounts for a substantial component of its market valuation, even if we account for the varying age and complexity of its hospitals. This portfolio will also provide Ramsay with valuable growth options in the future.

The value of this portfolio was no doubt a consideration in private equity firm KKR’s offer to purchase Ramsay in 2022. KKR’s $20b bid was significantly higher than Ramsay’s current market value of $8b.

There are early signs of improvement for Ramsay. In Australia, there was a 4.3% increase in medical episodes requiring hospital treatment in 2024, and an 8.1% increase in hospital benefits paid for by insurers*. In the UK, the 2024 tariff increase was revised up from 0.6% to 3.9% in November 2024. Furthermore, under the direction of new management, Ramsay is actively pursuing operational improvements and tightening reins on capital expenditure.

Ramsay will continue to face risks, including rising healthcare costs and exposure to government policy. There are concerns about a shift in demand away from overnight stays to day surgery, something Ramsay is somewhat exposed to. The outlook for Ramsay Santé is the most challenging. Time will tell whether the full potential of this business is realised for Ramsay shareholders, although our thesis does not rely on this.

As is always the case, our best protection to the risks that present is the price we pay. With Ramsay Health Care, we believe we are already compensated for much of this risk.

¹Department of Health and Aged Care, Private hospital sector financial health check, November 2024.

²Following the introduction AASB16, the accounting profession’s non-sensical gift of complexity to the investment community, lease costs are included in depreciation and interest expenses rather than operating expenses.

³Source: Medibank financial reports, 2019 – H1 2025

*Source: APRA, Quarterly private health insurance membership and benefits summary – December 2024, February 2025

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.