The dynamic duo – video

How we’re navigating markets and powering returns The Allan Gray Australia Balanced Fund continues to …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Being a contrarian investor means going against consensus and that can be testing. This difficulty is why contrarian investing can work, but to endure it, you need to really understand what you own. In this article from our sister company, Orbis discusses its rigorous, contrarian investment philosophy and how this is applied to the Orbis Global Equity Fund. This article was originally published on 28 February 2025.

Being a contrarian investor means going against consensus and that can be testing. This difficulty is why contrarian investing can work, but to endure it, you need to really understand what you own. In this article from our sister company, Orbis discusses its rigorous, contrarian investment philosophy and how this is applied to the Orbis Global Equity Fund. This article was originally published on 28 February 2025.

Last month we discussed the outstanding returns of the US stockmarket over the last 15 years, what drove that performance, and what investors need to believe to expect similarly stellar returns in the future. That analysis leaves us sceptical that the US market is poised for attractive long-term returns today. As the US represents some 70% of world stockmarket indices, that leaves us similarly sceptical about the long-term returns on offer from global passive portfolios.

In addition, there are signs of speculative enthusiasm. Valuations are high, and stockmarkets are concentrated in both composition and performance. Froth in cryptocurrencies is alive and well. Investors able to hold cash don’t hold much of it. Parallels with past speculative periods, like the Nifty Fifty era in the early 1970s or the technology bubble in the late 1990s, are starting to pop up more often.

Yet we don’t see an obvious stockmarket bubble, nor an inevitable stockmarket crash. Unlike the tech bubble, the leading stocks today are real companies, and really good ones. Why, then, would we not hold more of the market juggernauts, or have a larger exposure to their thriving home market?

Put simply, because we think we can find much better opportunities from today’s starting point, and we try very, very hard to find the best ideas we can.

Some of those ideas are the juggernauts. We have owned Alphabet for years. Some of our stockpickers find Microsoft and Amazon attractive, and Meta looks reasonable enough to warrant some work. On the other hand, Tesla’s share price is a hype-driven rollercoaster with little regard for its fundamentals.

We scratch our heads at Apple’s ever-rising valuation for ever-slower growth. And Nvidia, which three different Orbis analysts have looked at over the past two years, seems to us an excellent business—but one with exceptionally high expectations reflected in its share price.

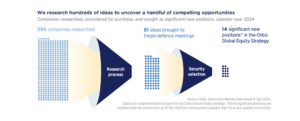

Most of our best ideas, however, are not the stocks you see in headlines. As the process graphic below shows, our bar is high.

Last year our analysts around the world looked at 395 companies. From there, ideas run the gauntlet of our phased research process. Being a contrarian investor means disagreeing with the market, and that is testing. Challenging voices vastly outnumber supportive ones. This difficulty is why contrarian investing can work. But to endure it, you need to really understand what you own. Building that understanding requires time, and finding that time requires focus. Accordingly, we encourage our analysts to be ruthless in rejecting all but their most compelling ideas. Of the 395 companies that we analysed last year, only a fifth were considered for purchase in the Orbis Strategies. Those 81 ideas were then picked apart at thesis defence meetings, where we interrogate the analyst’s investment thesis to reduce the risk of making mistakes. Only 14 companies were ultimately bought as significant new positions in our Global Equity Strategy.

We turn over hundreds of ideas, but less than 4% are compelling enough to beat out the companies the portfolio already holds. The bar ideas must clear is not “average”, or “reasonable”, or “fair”—we are looking for the most attractive opportunities we can find, anywhere in the world. Every day, our work continues.

Financial advisers can contact their local Business Development Manager to learn more about the Orbis funds.

This presentation has been designed for institutional/professional investors or professional advisers. It is not suitable for a direct retail audience.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.