The dynamic duo – video

How we’re navigating markets and powering returns The Allan Gray Australia Balanced Fund continues to …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

It’s been a tough decade for value-oriented contrarian investors. The global index has become concentrated and skewed, as a small number of shares have pushed markets to extremes. But when change happens, it can happen all at once, as this last quarter has demonstrated. Is the reset over? Orbis discusses this and its fund positioning in the following article.

It hasn’t been a great decade to be a value-oriented contrarian investor.

When compared against a soaring and increasingly concentrated global stockmarket, the opportunity for investors like us to deliver enhanced returns has been relatively bleak.

To be sure, scoring a few own goals along the way hasn’t helped. Our mission is to generate superior returns vs our benchmark with no greater risk of loss. And, while our net returns over the last decade have been strong in absolute terms, they’ve fallen short of the benchmark’s returns. We recognise that we have tested your patience.

Looking back, there have been two big factors at work. The first is our own internal processes and structure. With the benefit of all the data we’ve collected and analysed on our own decisions, we’ve identified several opportunities for improvement, and we have made changes.

Over the last three years, we’ve combined two of our London investment teams, changed our portfolio management structure to improve capital flow across regions, and enhanced our risk management, both at a stock-specific and portfolio level. Notably, we have also formed a Decision Analytics team to analyse our individual behavioural patterns as investors, akin to a golf coach videoing a player’s swing.

Although hard to measure with precision, we believe these initiatives are already bearing fruit. For example, by comparing our analyst team’s recommendations with the global opportunity set, we can see that the output of our “stockpicking engine” is significantly outperforming the typical global stock.

The other big factor is the market environment. We have written at length previously about how concentrated and skewed the global stockmarket benchmark has become, driven in large part by a very small number of shares which have pushed markets to extremes. Even if we had been at the top of our game, the environment of the last decade would have been a tough one in which to excel.

But one thing we have repeatedly observed is that when change happens, it can happen all at once—as this most recent quarter has demonstrated.

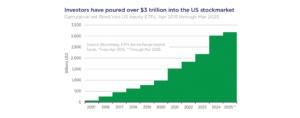

One minute, the stockmarket is in a state of euphoric ecstasy, convinced by the notion of American exceptionalism and giddy on expectations for the unshackling of that country’s animal spirits under a decisive, business-friendly, red-tape-cutting administration. Investors pour in.

The next minute, despondency reigns. Tariff inflation will hurt consumers, and tariff uncertainty will hurt businesses. Cutting waste will mean cutting jobs, which means rising unemployment, which may mean recession.

It’s just the other side of the same coin. But that’s the nature of economics, and investing. There are two sides to everything. What drives market prices is often determined by which side of the coin investors are choosing to look at.

We find there’s usually more to be gained by carefully examining the dark side of the coin. Looking from the other side can feel lonely and adversarial, and comes with long periods of looking stupid. But when the market environment flips, it can do so quickly, without warning, and without an intermission to let investors reposition.

For example, our long-standing underweight to the US, a relative performance drag for so long, has all-of-a-sudden flipped into a contributor. If predicting the timing of such changes in market mood can look easy with hindsight, it’s anything but simple in real time—and that’s exactly why we don’t do it.

Instead, we’re guided by how share prices deviate from our assessment of intrinsic value. While our disciplined approach can often mean we end up sitting out periods of extraordinary temporary returns as certain shares go from expensive to even more so, it’s usually worth it in the end. Share prices can only fight for so long against the gravitational pull of fair value.

The first sign that share prices have gone too far is often that even extraordinary results fail to meet lofty market expectations. In late February, Nvidia reported 78% growth for its most recent quarter, yet its stock was down the next day.

And it has not been alone. While the S&P 500 is down 8% from late February, the tech-heavy Nasdaq is down 13%, and the Magnificent Seven are collectively down 17%.

Does that mean those shares now provide good value again? Is the reset over? Not necessarily. When one considers just how stretched and skewed markets had become, it’s possible there is further to go. On a headline basis, the US still commands a 45% valuation premium. Indeed, our research continues to suggest there is much better value elsewhere. Whether it’s the likes of SK Square trading at a fraction of the value of its listed stakes, Genmab trading below the value of its existing drugs (with no value credited to future development) or the solid Elevance Health at just 13 times next year’s earnings with no discernible tariff risk, we continue to find shares priced at very reasonable levels with attractive margins of safety to the downside.

On previous occasions when markets have become as dislocated as they still are today, we’ve typically found that shares neglected in the euphoria don’t just protect downside in a market sell-off, they can actually go up as investors remove their blinders. So it is that, amid the declines in the Nasdaq, European stocks are actually up year-to-date. In dollars, Japanese shares are up. Global value stocks are up.

In terms of pattern recognition, that’s an encouraging sign for value-oriented contrarian investors like us. Looking forward, we hope and expect that our discipline—and your patience—will finally turn out to be well rewarded.

Financial advisers can contact their local Business Development Manager to learn more about the Orbis funds.

This insight has been designed for institutional/professional investors or professional advisers. It is not suitable for a direct retail audience.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.