The dynamic duo – video

How we’re navigating markets and powering returns The Allan Gray Australia Balanced Fund continues to …

We want to ensure you get the right experience for you.

Discover the Allan Gray difference. Learn more about our Funds including performance and download offer documents.

The information contained in this section is for adviser and wholesale investor use only.

The Allan Gray Australia Funds are available for investment by New Zealand retail clients.

To comply with New Zealand law, our website provides information only about Allan Gray Australia Funds. We do not provide advice to New Zealand retail clients.

You are about to enter Allan Gray Australia.

If you are looking for Allan Gray South Africa, please click here.

US persons are not generally permitted to invest in the Allan Gray Australia Funds. However, we will accept applications from US persons who are genuine residents of Australia, New Zealand or South Africa.

Some sectors of the Australian sharemarket have been on a tear this year. At times it has felt like market participants are enjoying a white tablecloth dinner on top of an active volcano. In this extract from our September 2024 Quarterly Commentary, Portfolio Manager Dr Suhas Nayak digs deep into one of our fund holdings that hasn’t been caught up in the furore, Incitec Pivot, and explains the thinking behind our investment.

Although tempting, we’ve resisted the urge to write about Australia’s banks that have been on a tear this year (and to which we are currently more underweight than we’ve ever been since the Allan Gray Australia Equity strategy’s inception almost 20 years ago). The same is true for Australia’s technology index, which has handsomely surpassed its late-2021 post-COVID-19 price peak.

Although tempting, we’ve resisted the urge to write about Australia’s banks that have been on a tear this year (and to which we are currently more underweight than we’ve ever been since the Allan Gray Australia Equity strategy’s inception almost 20 years ago). The same is true for Australia’s technology index, which has handsomely surpassed its late-2021 post-COVID-19 price peak.

At times, it feels like market participants are enjoying a white tablecloth dinner on top of an active volcano. To counter this, we have been surprised by the resilience of corporate earnings in the face of inflationary headwinds and a seemingly weak consumer. Let’s hope this continues!

For this Quarterly Commentary, instead of tabling an almostcertainly incorrect economic forecast or outlook for corporate earnings, we’ve decided to opt for a deep dive into one of our portfolio holdings, Incitec Pivot. Writing about companies in which we invest is not only more comfortable for us (our happy place!), but it is also a topic where we feel we have about a 60% chance of being right (much better than almost certainly wrong and a surprisingly decent probability in the world of investing).

Dr Suhas Nayak, Portfolio Manager and Analyst, digs into Incitec Pivot below and explains the thinking behind our investment.

We first bought shares in Incitec Pivot, a chemical manufacturer and supplier, in 2019. At the time, the company had experienced difficulties due to low ammonia prices (a key driver of earnings across the various Incitec businesses). Poor decisions around capital spending in the decade before had resulted in a stretched balance sheet and pennywise but pound-foolish decisions had arguably affected reliability at a number of its manufacturing plants. The weather had also disrupted output at one plant.

We first bought shares in Incitec Pivot, a chemical manufacturer and supplier, in 2019. At the time, the company had experienced difficulties due to low ammonia prices (a key driver of earnings across the various Incitec businesses). Poor decisions around capital spending in the decade before had resulted in a stretched balance sheet and pennywise but pound-foolish decisions had arguably affected reliability at a number of its manufacturing plants. The weather had also disrupted output at one plant.

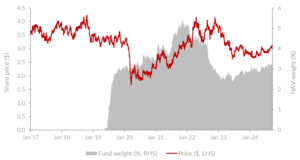

Since then, a deeply discounted capital raising during COVID-19 and the sale of Incitec’s US ammonia plant have resulted in a deleveraged balance sheet, even after a significant capital return. While the business has changed over the years, and so too have our holdings (as shown in Graph 1), we believe there is still sufficient value in the shares to warrant a position in the Allan Gray Australia Equity strategy portfolio.

Incitec Pivot has two main businesses today. One is an Australian and North American manufacturer and supplier of explosives used by the mining and quarry industries and operating under the Dyno Nobel brand. The other is a manufacturer and supplier of fertilisers with a strong market position in Australia. What unites the two businesses is their chemistry, as the products produced by Incitec Pivot in each division have a common nitrogen basis. However, it is worth looking at each of these businesses separately.

Source: Allan Gray Australia, 23 September 2024. The Allan Gray Australia Equity Fund is generally representative of the Equity strategy portfolio, which includes institutional mandates that use the same strategy.

Ammonium nitrate is the raw bulk material used in Dyno Nobel’s explosives. The process to make ammonium nitrate (NH4NO3) involves first making ammonia (NH3) from natural gas (mainly methane or CH4) and nitrogen (N2) from the air, and also making nitric acid (HNO3), which are then combined. Incitec Pivot makes ammonium nitrate in a few plants around the world:

To be a successful manufacturer of ammonium nitrate, a company needs a low gas price (or a low ammonia price) and assets close to end-user demand. Incitec Pivot’s Moranbah plant is well-positioned relative to competitors on both fronts. This is also true at Cheyenne and LOMO, but with some risk around overall end-user demand for thermal coal.

On top of the manufacturing of bulk ammonium nitrate, Incitec Pivot has a number of other assets, from emulsion (formulations that improve the stability and in turn, safety, therefore allowing for easier transportation of explosives) plants to mobile processing units1 , that help deliver products to customer sites.

In Australia and North America, Dyno Nobel is a top-two market player in explosives. It is also expanding cautiously in other markets, organically in South America, and through an acquisition in Europe and Africa. The company believes these geographies will provide a runway for capital-light growth in the years ahead.

The fertilisers business in Australia comprises primarily the Phosphate Hill diammonium phosphate manufacturing plant (and associated mine) and a distribution business with a strong market share. This unit has had several challenges:

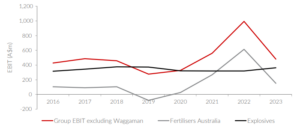

Incitec Pivot’s current market capitalisation is $5.8b, with a further $300 million (m) net debt for a total enterprise value of $6.1b. We can see from the earnings before interest and tax (EBIT) figures in Graph 2 that the two businesses have quite different characteristics:

Source: Incitec Pivot company filings. 30 September 2024. Numbers don’t add because of corporate and other eliminations.

Based on this, the market is valuing Incitec Pivot on 12.8 times to 13.4 times the earnings before interest and tax that we could reasonably expect from explosives, Australian fertiliser distribution and corporate. This is similar to the multiple Orica (a close competitor) trades on, but is below the multiple the broader market excluding banks trades at. Importantly though, it assumes that no value is ascribed for Phosphate Hill, an asset we feel that shareholders are being paid to own, and no value for the surplus land at Gibson Island and other facilities. In its latest investor update, Incitec Pivot set even higher earnings targets for its explosives business by FY26.

While the above seems relatively attractive, there are always risks in any investment and reasons that sellers might have for offering shares at these prices.

There are shorter-term risks around Phosphate Hill’s reliability and its gas supply, which could even lead to losses at that manufacturing plant. And longer term there are risks around thermal coal in North America, with 20% of Dyno Nobel’s North American revenue exposed to thermal coal, the demand for which has been in long-term decline. There is a chance a more rapid decline in demand would make Dyno Nobel’s plants in North America far less profitable. This is at least partly tempered by critical mineral extraction becoming an ever deeper and lower-grade phenomenon which will require increasing amounts of explosives and, importantly, higher-margin services.

It is hard to accurately predict Incitec Pivot’s future but, despite some potential future issues, we see Incitec Pivot shares offering reasonable value. With new management and a refreshed capital-allocation-focused board, some of that value may actually be realised for existing shareholders. It is currently a little over 3% of the Allan Gray Australia Equity strategy portfolio and may soon go by the name Dyno Nobel once again.

Equity Trustees Limited ABN 46 004 031 298, AFSL No. 240975 is the responsible entity and issuer of units in the Allan Gray Australia Equity Fund ARSN 117 746 666, Allan Gray Australia Balanced Fund ARSN 615 145 974, and Allan Gray Australia Stable Fund ARSN 149 681 774 (Allan Gray Funds). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487 is the investment manager of the Allan Gray Funds. Neither Allan Gray Australia Pty Limited, Equity Trustees Limited nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it.

Past performance is not a reliable indicator of future performance. There are risks involved with investing and the value of your investments may fall as well as rise. This represents Allan Gray Australia Pty Limited’s views at a point in time and may provide reasoning or rationale on why we bought or sold a particular security for the Allan Gray Funds or our clients. We may take the opposite view/position from that stated, as our view may change. This insight is not an offer or recommendation, constitutes general advice or information only and not personal financial product, tax, legal, or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person and may not be appropriate for you. We have tried to ensure that the information here is accurate in all material respects, but cannot guarantee that it is.

You should consider the relevant Product Disclosure Statement (PDS) before acquiring, holding or disposing of units in an Allan Gray Fund. The PDSs, Target Market Determinations (TMDs) and Minimum Disclosure Documents for South African investors (MDDs) can be obtained from our Forms & Documents page. Each TMD sets out who an investment in the relevant Allan Gray or Orbis Funds might be appropriate for and the circumstances that trigger a review of the TMD.

Managed investment schemes are generally medium to long-term investments. They are traded at prevailing prices and the value of units may go down as well as up. There are risks with investing the Fund and there is no guarantee of repayment of capital or return on your investment. Subject to relevant disclosure documents, managed investments can engage in borrowing and securities lending. A schedule of fees and charges is available in the PDS.